-

The above Banner is a Sponsored Banner. Upgrade to Premium Membership to remove this Banner & All Google Ads. For full list of Premium Member benefits Click HERE.

Content Type

Forums

Premium Membership

Dealer Directory

Wiki

Videos

Prize Draws

Posts posted by Abyss

-

-

- Popular Post

- Popular Post

-

-

Putting aside @Wonger wild west predictions two camps one believe have deflation followed by inflation/hyper-inflation and the other camp believe no deflation just inflation/hyper-inflation. In either scenario provided have a strong hand and are holding onto the physical Gold you will have at the very least preserved your purchasing power. Looking back at history before Weimar republic hyperinflation Gold lost 40% value imply $1700 trading back to $1000. Everything happening lighting speed and we have had the fastest sell off in equities in history.

We could already had the deflation of Gold $1700 to $1450 15% and today tech savvy clued up world everyone wants to protect their assets and Gold one of those assets types serves this purpose.

I believe @Wonger can buy Gold at $400 as soon completes his purchase of the following item

Unfortunately Emmett Brown gone into Self-Isolation no going back in time to 2004 for @Wonger to buy $400 Gold.

-

-

I was genuinely shocked beyond belief price action GBP/USD today at one point it fell from 1.210 all the way down to 1.145 relatively short time frame 7 am to 5 pm and GBP lost 5.3% against the USD. 550 pip moves on the majors (AUD/EUR/GBP/CAD/USD/CHF/JPY) are extremely rare.

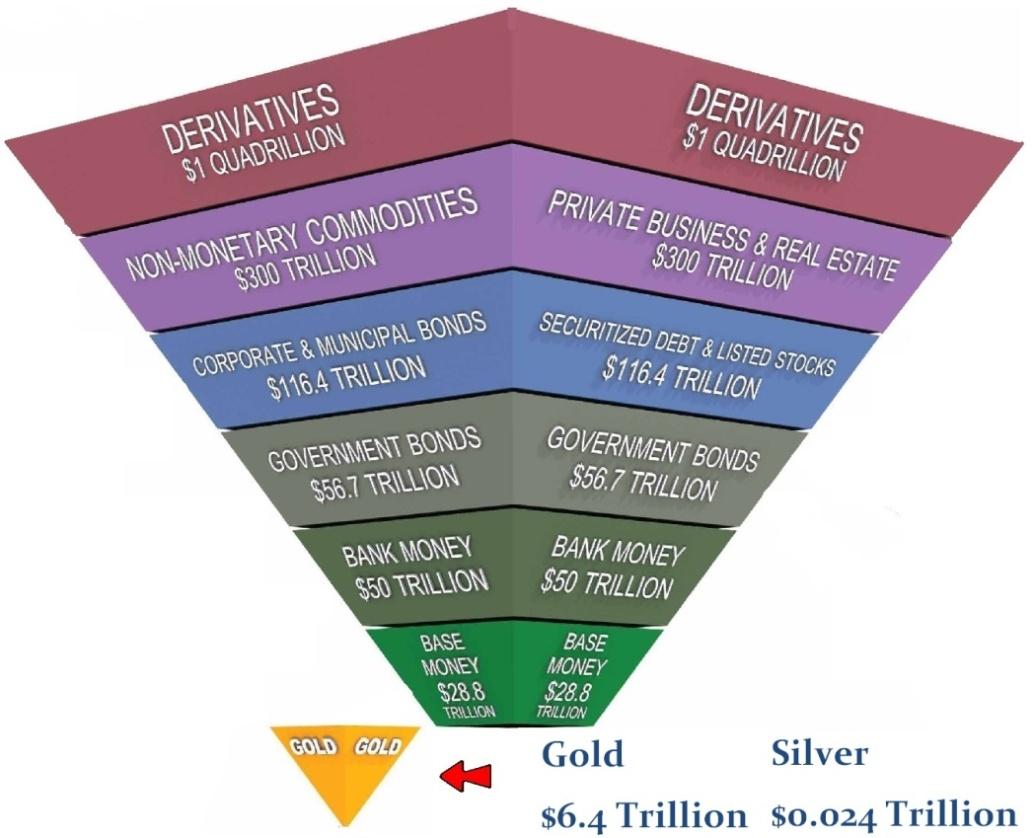

I know we are heading down Exter's Pyramid (we are on US Government Bonds / USD Bank Money right now as the USD is the reserve currency of the world) but the rapid price actions across multiple asset classes leaving very little time to protect and position yourself. Shale industry US could lead corporate debt bubble explosion. I have seen crazy currency moves in Venezuela / Turkey / Argentina but never thought I would ever see devaluation GBP over 5% single day.......

-

In the 2008 financial crisis things happening using the same play book but a lot quicker and faster. We have the shortest amount of time Dow losing 20% in bear market. What we are seeing in global markets, currency markets (GBP/USD at 1.32 last week now at 1.22) moves in PM happening at record pace. My initial thought wait a month for Silver below $14 and Gold below $1500 and back up the truck but witnessing volatility and price movements in all assets classes never seen before.

-

No yield or interest and it is just pretty yellow metal sits there for all time as powerful force as gravity. All other assets go through cycles but ounce Gold will always be worth an ounce of Gold.

Quote by Abyss on the Silver Forums

i don’t know acceptable come up with your own original quotes......

- EdwardTeach and Zhorro

-

2

2

-

Three key prices to keep eye on Gold in $, Gold in £ and £ vs $. Continue to see flight to safety because global Corona virus in Gold and the US Dollar the $ price of Gold will increase, $ increase vs other currencies. Gold has been the best hedge against uncertainty and currency devaluation. In the coming weeks and months we should see all time high price of Gold in £.

-

-

40 minutes ago, Zhorro said:

Gold is supposed to be a “safe haven” – yet at a time when one would have thought a “safe haven” was needed, gold was smashed today. But why?

When we have asset bubbles that pop (stock markets around the world likely followed by housing markets) it is a deflationary environment where assets prices fall that include Gold and Silver (more Silver because it is viewed as a industrial metal with weaker global economy there is less demand hence lower price is reflective of a similar move in oil). We could see several months of asset bubble depreciation and lower Gold price that forces out all the weaker hands but when Gold ready to make it's next leg higher it will be significantly more than £1290.

Wait for the central banks to give out helicopter money and watch Gold price soar.....

https://edition.cnn.com/2020/02/26/economy/hong-kong-budget-2020-economy/index.html

- goldmember44, Nick1368 and Darr3nG

-

2

2

-

1

1

-

1 hour ago, Nick1368 said:

OMG madness, so happy that I bought 8oz in January at £1200

I am happy I bought 8 oz £1138 in late December 2019. I am even more happy I switch my entire portfolio in India from Nifty 50 to Money market Bonds in the middle January, stock markets sea of red Dow 800 point down and US Markets 3 and half hours before opening. Will we see 1,000 point drop in day for the Dow?.....

The VIX volatility index 30% higher.

NASDAQ bubble has finally popped.

-

Already passed the all time high £1281 as it spike to £1296 in the early hours.

-

11 minutes ago, goldking said:

Does that 0.02% loss include all of their commission, storage, transaction and insurance fees?

Good point @goldking have to read the small print so many different charges apart from just the spread........

https://www.bullionvault.com/help/tariff.html

-

27 minutes ago, goldmember44 said:

I would never, ever risk my money to buy "gold" that is stored somewhere else, that I will never see. Sorry. Just physical for me.

I think it all depends on your time horizon and your beliefs. I can certainly see the appeal of using a service like Bullion Vault the spreads between buying and selling is competitive and if you bought and had to sell in a short time frame (provided spot price did not move) then in theory you only stand lose 0.02% (Gold London £) and it is impossible to achieve this spread in physical Gold and practicality and flexibility to buy and sell 24 hours day seven days a week without having pay postage costs or a need to find a buyer/seller.

I believe in the last 10+ years this probably one of the most efficient ways to buy Gold but the economic, political environment that we have recently entered has changed. HSBC are the custodians GLD and the majority of their profits are derived from Hong Kong the most overvalued housing market on earth, Deutsche Bank derivatives exposure, corona virus black swan event and central banks around the world attempted trying to keep stock markets at all time highs by pumping liquidity, federal reserve started QE4, we have no idea over last five decades how much gold leased out but still on the balance sheets central banks as reserves. Nobody can predict in the interconnected financial/global economy that we live in today if one domino falls what implications it will have on others.

If your objective is to be completely out of the system, have zero third party risk and lock in purchasing power indefinitely then holding physical gold is the way to go.

Plus holding physical Gold is good enough for these fine fellows then good enough for me.

- Dobber and goldmember44

-

2

2

-

- Popular Post

- Popular Post

Thank you @BackyardBullion for the following provident metals world of dragons coins

Help me finished off the series.

- Darr3nG, ittle5huggy, richatthecroft and 12 others

-

13

13

-

1

1

-

1

1

-

I will get the discussion back on topic @ChrisSilver.

November 2018 I managed to complete a backdate 10 x 1oz Gold Queens Beast Lions cost me £1250 per coin. At the time I was doubting if spot Gold ever get to £1250 an ounce and if I made the right decision. Looking at the spot price and premiums on these coin I would not be in position to back date them now....

-

The last impulse wave taken gold from $1455 to $1615. As long price action reveals months of sideways price action and consolidation or develops into slow channel downward price movement without any major swings lower and the previous swing low $1455 respected then hold and wait until the next impulse wave higher.

Everything read/watched my mindset hold onto the physical yellow metal for at least a decade. A lot of talk about safe heaven assets and Gold and the Dollar to rise together over next decade but ultimately Gold will be the overall winner.

-

- Popular Post

- Popular Post

Last PMs received 31st December 2019 thank you @SilverStan only just got round opening the parcel this evening.

Intaglio Mint Molon Labe fan of spartan's great series last photo all the coins in the series so far released together.

- richatthecroft, SilverStan, motorbikez and 14 others

-

14

14

-

1

1

-

2

2

-

https://www.chards.co.uk/1-ounce-gold-coin/1oz-gold-bullion-coin/one-ounce-best-value/486

1 oz Gold Coin Bullion Best Value Secondary Market

-

3 minutes ago, Melon said:

😮😮😮

Awesome. Truly awesome.

Although I don't think these qualify as full stack photos. I count 74 oz, where's the other 0.25 oz?! 🤣

I was counting Mexican 50 Peso as 1.25 oz Gold but the Pure gold content (grams): 37.503 you are right @Melon not 74.25 oz technically it is 74 oz and 6.368 grams Gold

.

.

-

- Popular Post

- Popular Post

Visited my safety deposit box today and put the recently acquired Gold with the rest of the Gold stack. Don't visit Safety Deposit box that often maybe once a year and took opportunity to take some photos. Gold bullion occupying 25% space in the box the remainder family jewellery. Still enough room in the box to add another 40 oz Gold in Royal Mint tubes to finish off Queens Beasts series.

Gold bullion square red box total 74.25 oz.

-

- Popular Post

- Popular Post

Received these today sent by @kneehow2018 8 x 1 oz Gold 2016 Britannia's very well packaged thank you.

I did not own any foreign Gold coins or Britannia's but picked fair amount just in the last couple of months.

-

I am unsure going to see the next leg up in Gold price but technically looking like re-testing $1550 level Gold price again. Chart below from Trading View weekly Gold price in USD (free website use) https://in.tradingview.com/. Develops into the next lag my target price $1850. Easily just re-test $1550 level and then find enough resistance re-test $1400 level.

-

- Popular Post

- Popular Post

Full Stack / Full Collection Photos

in Photo Only Topics

Posted

All my Gold is in a safety deposit box and the only Gold I have to hand (apart from my wedding ring) is this beautiful Gold dripped Rose gave to my wife on our anniversary. Rose is a symbolic representation of the Gold have in my stack.

https://www.amazon.co.uk/Living-Gold-Rose-Real-Dipped/dp/B00BF135KU