-

The above Banner is a Sponsored Banner. Upgrade to Premium Membership to remove this Banner & All Google Ads. For full list of Premium Member benefits Click HERE.

HawkHybrid

Content Type

Forums

Premium Membership

Dealer Directory

Wiki

Videos

Prize Draws

Posts posted by HawkHybrid

-

-

1 hour ago, Minimalist said:

Someone can bring out figures but they will be manipulated from the position of understating the rate of inflation which invertedly keeps Silver down - not to its true price.

always someone who insists on calling it manipulation.

from 1980 until 2000 silver has dropped from ~$50/toz to ~$5/toz.

you don't need to know what the exact inflation rate was from 1980-2000.

all you need to know is that there wasn't a deflation of about -90%, to conclusively prove

that silver did not come anywhere near close to tracking inflation from 1980-2000.

HH

- Tortoise, GoldDiggerDave and Booky586

-

3

3

-

2 hours ago, GoldDiggerDave said:

I'm seeing so much on websites and social media with individuals saying hold silver as a hedge against inflation.

anyone who is telling you to hold silver as an inflation hedge is either too stupid to recognise that gold

exists or is purposely trying to mislead you(in order to try and sell you silver? maybe).

historic data shows that silver does by and large track average inflation over multiple decades.

but did not track inflation during the two decades that was 1980-2000. note how gold also did not track

inflation between 1980-2000, but has made up some ground for 1980-2020. silver is currently still lower

than it's non inflation adjusted price in 1980($50/toz). is it underpriced now or was it overpriced in 1980?

(hunt brother tries to corner the silver market, which would have resulted in a complete monopoly). let's

see how many forum members are going to defend that silver was not stupidly overpriced in 1980(due

to behaviour that would have lead to a complete monopoly).

2 hours ago, GoldDiggerDave said:I just can't see it and honestly I'm not out to disprove (quite the opposite) I can not see how it's a "hedge" against real world inflation.

it's not about proving or disproving that silver has historically tracked inflation.(anybody waiting for silver

to track inflation from it's 1980 peak are not even remotely close to being correct, even after 40 years).

silver pumpers are too blind to see that silver has a multi decade cycle. telling them that it's perfectly

possible that they can be old and retired before their silver 'investment' pay dividends is not what they

want to hear when they've already entrenched themselves with 'silver as a get rich quick' scheme.

silver loses to gold in many scenarios, but silver does have it's rightful place as a niche holding next to gold.

HH

-

53 minutes ago, Junior said:

Well I believe it’s not a poor example at all. Silver is only used in minuscule amounts in many applications. Let’s take an automobile as another example. The Internal Combustion Engine (ICE for short) uses between 1-2 ounces of silver for the computers, circuitry, and sensors. An electric vehicle will use between 2-3 ounces. Add up all the cars sold the world over and those minuscule amounts add up a lot.

what the point of selected instances being able to afford a rise in the silver price when the

industries that account for 50% of demand would have trouble paying for it?

https://www.ev-volumes.com/country/total-world-plug-in-vehicle-volumes/

let's estimate world electric car sales at 2x3(6) million per year each using 3 toz.

that's a grand total of 18 million toz. that's still a bit under the amount that is used by the dwindling

traditional photography sector(~28 million toz). what about payment for the other 900+ million toz?

I gave solar panels as an example. it currently accounts for 10% of world silver demand.

https://werecyclesolar.com/how-much-silver-is-used-in-solar-panels/

silver can be up to 6% of the cost building each panel. if the silver price doubles like it has done recently,

solar panel would go up by maybe 6%. what a surprise that when silver accounts for a large % of costs is

also in sectors that make up more of the worlds demand for silver.

are you purposely counting peanuts whilst ignoring the elephant in the room just so that you can skew

the weighting in favour of less significant sectors?

HH

-

42 minutes ago, Junior said:

Let’s take a computer as a good example. Contains a mere 1/10 of an ounce of silver. Hardly worth much more than a cup of coffee really. A computer can be priced vastly depending on the make, model, etc…. But let’s assume that a good computer can be worth $2000 USD. Now let’s assume silver rises from $22.50 USD per ounce to something absurd like $2250 USD per ounce. Well with only 1/10 of an ounce in a computer used to run it, then the price of that 1/10 of an ounce just jumped from costing $2.25 USD to costing $225 USD.

Let’s also assume that the raw price increase is fully transferred to the buyer of the computer (the exact $225 per 1/10 ounce). No one says, “Well at $2000 I would buy the computer, but at $2225 I can’t afford it!” Point being, because it’s such a small amount that goes into these electronics, it doesn’t matter if the price is low or high. The commodity is needed and the price can be passed on to the consumer.

So while you can use a computer without knowing how it works, I wouldn’t recommend investing in a key component of that computer without knowing how it is used and in what quantities.

a poor example that highlights nothing.

no one cares about the tiny pittance of silver that your computer has in it. they care about the big things like

industrial applications which account for ~50% of each years total demand.

https://www.silverinstitute.org/silver-supply-demand/

of which solar panels(photovoltaic) currently accounts for a 5th of that or ~10% of silver demand in recent years.

since 2012 traditional photography has reduced by about 25 million toz but jewellery has increased about 25

million toz.

since 2012 the total demand for silver has been flat overall but certain applications have shown to have

dwindled significantly.

HH

-

28 minutes ago, Junior said:

This is true. But can you invest in silver without knowing the connection points between it and the things it does?

yes

59 minutes ago, HawkHybrid said:same with investing in silver. I just need to know when the silver price is below it's long term average

in order to buy and above it for selling.

did you not read this?

HH

-

6 hours ago, Junior said:

Just to argue this point: silver averaged $4.03 USD in December 1991. According to US data stats, based on the CPI (Consumer Price Index) i.e. the inflation benchmark, silver should only be $8.13 USD present day (December 2021). Arguing of course that if silver is above this price, it is ahead of inflation. Which would suggest @HawkHybrid is perhaps correct in the assumption that silver’s rise is with inflation (approximately).

However, using shadow stats by John Williams (who used to work with US inflation numbers back before the CPI had been changed by dropping or substituting certain commodities), he comes up with a different number. John uses the original CPI which had a more diverse basket of goods and commodities that would give a more accurate reflection on the inflation numbers. His original formula shows that silver priced at $4.03 USD in December of 1991 should be valued closer to $71.77 USD December 2021. Which would now suggest that @HawkHybrid is incorrect in the assumption that silver’s rise is in-line with inflation.

Silver’s price currently as I write this is $22.37 USD. By the new CPI benchmark, it is ahead of inflation. But by the old benchmark, it is not. Which one is correct? Or more importantly, why did they have to shrink/change/substitute the old CPI basket of goods and commodities?

people always like to bring up the way inflation is/should be calculated and it is a moot point for

practical purposes.

I can effectively use a computer whilst not knowing how all of it's internals are calculated or works.

I just need to know enough about it to be able to use it.

same with investing in silver. I just need to know when the silver price is below it's long term average

in order to buy and above it for selling. charting programmes will offer you ema , sma, whatever moving

average for whatever time frame that you want. choose one that works for you and read off the number.

government inflation tracking indices are there for governments to 'prove to voters' how good they are

with inflation. these have nothing to do with the real world application of investing in silver. inflation is

notoriously difficult to track in our ever changing world. enabling a moving average on the silver chart is

a few clicks away, accurate to the data set and to the point. alternative you could waste all of your time

arguing why a government made up inflation measuring index is not actually measuring inflation accurately

and only serves to make the government look good(well duh, because making the government look good

is the sole purpose of it's existence?)

you just need to understand that long term inflation tracking means that short term(over a decade is possible)

inaccuracies is probable.

HH

-

6 hours ago, Junior said:

If you believe silver is not manipulated, then why do you invest in it?

the question should be if you believe silver is manipulated then why do you invest in it?

do you purposely go and gamble at a casino that is known to have rigged outcomes?

purposely play against cheats and get cheated of what should be your winnings?

or do you think you are so important that you will make everything right and get rich in the process?

who was buying silver when the wall street silver pumpers were shouting from every roof top of

how silver would go to the moon? not me.

there are plenty of real world practical reasons why people would still buy silver knowing that it

only tracks inflation long term.

these include

1. using it as a cheap entry inflation hedge.(as savings is especially useful for those inclined to spend every

penny that they currently hold, but they should convert it to gold once in a while for long term savings.)

2. buying it as the speculative part of a larger metals portfolio.

3. only buying it when it goes below it's long term average. (long term inflation tracker doesn't mean that it

accurately tracks inflation every second of every day. short term swings lasting over a decade is possible.)

all the people who are buying silver because they believe the world 'must' reset and make them filthy rich,

are conspiracy theorists who haven't thought it through. there are real life reasons to buy silver, but most

of the scenarios don't include 'silver as a get rich quick' scheme.

silver as an investment is not a get rich quick scheme.

HH

- MetalMandible, Centauri167, saynow and 1 other

-

4

4

-

51 minutes ago, Bigmarc said:

I always think manipulated is a bit of a strong word but when you compare silver to other commodities such as oil, coffee and copper I can understand why others feel it is being suppressed. As for why? I dont really know, maybe something to do with the paper market.

the silver price is not being suppressed.

it's price is only rising long term in line with inflation as opposed to other commodities whose price exceeds inflation.

silver is falling out of favour. just as platinum has fallen out of favour in recent years versus gold. why would anyone

bet big on platinum if catalytic converters have an uncertain future? similarly why would anyone bet big on silver if

electronic power delivery, traditional photography, etc has an uncertain future? massive technological advances have

been made in computers, which reduces the need for silver, directly or indirectly. eg a solar panel powering a 45W

laptop is going to be physically bigger and need more silver than a much smaller solar panel that is required to power

a 25W laptop. over the generations, modern day 25W laptops are equal or more powerful/useful than the older 45W

laptops that they replace.

HH

- Roy and Centauri167

-

2

2

-

8 hours ago, Junior said:

Too bad the silver/gold ratio isn’t back to its historical/mined ratio. 8-20 ounces of silver to 1 of gold looking pretty sweet in my mind. Truly closer to 8 by most silver miners’ opinions.

I can't believe people still fall for the 'silver miners opinion that the silver price is too low' charade.

how is it not glaringly obvious that silver miners(who's business is to sell you silver) will only ever

have a one sided view that silver is under priced?

when was the last time you told your boss that they are paying you too much for your labour?

how about each year when you tell them that you deserve a pay rise for the work that you do?

a gsr of below 20:1 is a gimmick that silver pumpers tell potential buyers of silver. it's a sales

tactic that means nothing. read up on it, it was centuries ago when silver was deemed valuable

enough to be valued at it's natural in ground ratio to gold. spoiler, miners 'will not' as opposed to

'can not' mine more than ~10 toz of silver for every toz of gold. reason, they simply can't find

enough buyers for the additional silver that is mined.

HH

- TommyTwoShots, Centauri167 and Roy

-

3

3

-

wild guess sestertius, head facing right

possibly something like this

HH

-

2 hours ago, sixgun said:

what rubbish.

as I've said before currency inflation does not specifically affect only silver.

currency inflation affects everything that in denominated in that specific currency.

why choose silver to protect you against currency inflation when you can choose any other currency inflation hedge?

so far over the last 120 years it's done an appalling job keeping up with inflation and if a crisis hits like in 2020,

the silver price crashes.

HH

-

2 hours ago, sixgun said:

More uses doesn't mean something is more useful.

more uses does not make it more useful.

it's only more useful if you say it is so because you speak gospel without any need for reason.

why do I think you are constantly spouting rubbish?

HH

-

23 minutes ago, sixgun said:

Silver is more useful than gold.

gold has the most uses of any metal known to man.

1 hour ago, Junior said:Then we have a ratio of 16:1 (maybe 15:1) silver to gold in the year 1900, but that ratio is far stretched now. Why then is the silver price no longer a 16th or 15th of the price of gold? Why are we not looking at a price of silver closer to $110 or $118 per ounce which would correspond to a 16:1 or 15:1 ratio while gold sits at $1774 present time?

in the early 1900's the then coinage laws dictated that a sovereign is equal in value to 20 shillings.

by silver and gold coinage weight this made the gsr ~16:1. however,

£1 sterling literally represented one pound(slightly different to the current day lb) of sterling(92.5%) silver by weight.

using this, by bullion weight of measurement the gsr at that time would be ~48:1

(think of it as why a 1 toz silver britannia is £2, but a £20(£20 for £20 coin) is half a toz? the coinage £ to silver weight doesn't

actually represent the true £price/toz)

you need to go back a lot earlier before silver was actually trading 16:1 by weight.

1 hour ago, Junior said:Certainly we haven’t found much more silver than gold deposits over the last 120 years. Can someone clarify this for us all?

in ground silver versus gold is estimated to be ~16:1

the demand in silver over the last 120 years has not kept up with it's in ground rarity. we are currently only mining ~9 toz of silver

for every toz of gold being mined. there is a lot of un-mined silver waiting for buyers to turn up at the current price. this explains

why the current gsr is above the ~48:1 that was in the early 1900's.

HH

-

57 minutes ago, SidS said:

What would be interesting, for me at least as I always like to take the devil's advocate approach, is what is the value of paper? Specifically the paper used to print dollar bills.

What was the intrinsic value of the paper in a $1 bill when printed in 1900, comparative to the value of paper in a modern $1 bill? Has paper risen, or fallen in value? If it has fallen is it roughly in line with how silver has performed, or completely different?

missing the bigger picture?

in volume the physical cost of a $1 bill might cost less than 5 cents.

so you are focusing all your efforts on 5% of an items valuation because you are obsessed with the

outdated idea of physical intrinsic value. when instead you could research, debate and widen your

understanding of what makes the 95% valuation of currency what it is. knowledge and experience

don't have a physical intrinsic form but they can be extremely valuable.

HH

-

1 hour ago, sixgun said:

The last time i looked the quoted price of silver was not $42.32 new dollars

that's because silver is a rubbish store of value that failed to hold it's 2011 price of ~$50.

it's not that silver never reaches it's 1900 inflation adjusted price, it's that there are no (longer term substantial volume) buyers

at that price. not being able to find volume buyers at a spot price of $40+ means the silver price should fall until you can find

volume buyers totalling each years annual physical production. this is not manipulation, it's market price discovery.

HH

-

12 hours ago, Junior said:

So the reason I used 24 grams of silver and $0.04 from the chart are as follows:

24 grams represents how much silver was in a silver dollar in 1900 (and other years as well). So a dollar in 1900 represented the value of 24 grams of silver.

Since the dollar is no longer made out of silver, but rather paper, I relied on the chart to give the “value” as it showed in 2019.

The value of the dollar has declined to $0.04 (4 cents) to what it was compared to the year 1900. Which is why in my math I compare 24 grams of silver to the present day dollar’s value. And when you multiply 24 x $0.04 = $600. In essence, if you pegged the paper dollar to 24 grams of silver, that silver should be valued at $600.

Does that clarify the reasons why my math is done that way?

@swanky is correct, your maths(logic) is wrong.

the fact that it was 24g silver for each $1 coin has nothing to do with the depreciation of the dollar.

(does it make a difference if it was 24g = ~370 grains of silver? ie would it now be 370 grains divide by $0.04 ?)

the maths should be: $1(original coin value) divide by $0.04(current coin value) = 25

ie the paper $1 has depreciated by a multiple of 25, so it takes 25 current $1 to equal an old $1.

thus valuing an old $1 to be $25(current dollars) not $600(current dollars).

(what a huge surprise that when you do the maths correctly, $25 per 24g is not that far off from the current

spot price of $23/toz.)

the above is for clarification as it's all a moot point, as the analysis is next to irrelevant to the value of silver.

as I've pointed out it before if you replaced 'silver' with bread in your analysis, all of the dollar depreciation

analysis will be just the same and equally representative. dollar depreciation is not a silver specific thing,

it's a dollar specific thing and affects all items denominated in dollars.

HH

-

1 hour ago, Stacktastic said:

Im so fed up with this I sold all my gold stocks today!!

I have literally had enough now & think there are better avenues to invest.

I have more than enough physical to weather me in a storm.

FCUK the PM markets its crazy.

I shall catch it when it starts moving again. Im out.you might ask yourself 'what is your understanding of the gold market pricing?'

QuoteYes, there are seasonal variations with the gold price, and Oct-mid-Dec is usually weak, while mid-Dec-Feb is usually strong.

and 'do you agree with the above?'

investing is about making a judgement call from sufficient useful research data. many people try to jump in

and 'make it work/happen'. no doubt, constantly trying to go against the tide is a continuous up hill struggle.

HH

-

3 hours ago, Junior said:

What is the Value of

Silverbread?By: Jordan Graveline

What is the value of

silverbread? To answer this question, we must first ask ourselves: What is the value of a dollar? This question has plagued the modern investor, tax payer, and overall general consumer for many years. I will attempt to show what I believe the value of silver is by using the declining purchasing power of the US dollar.To start, I consider myself a young man with very little experience in the matters of economics. However, where some people see that as a weakness, I see it as a fresh pair of eyes, not yet corrupt by the system. So let us begin....

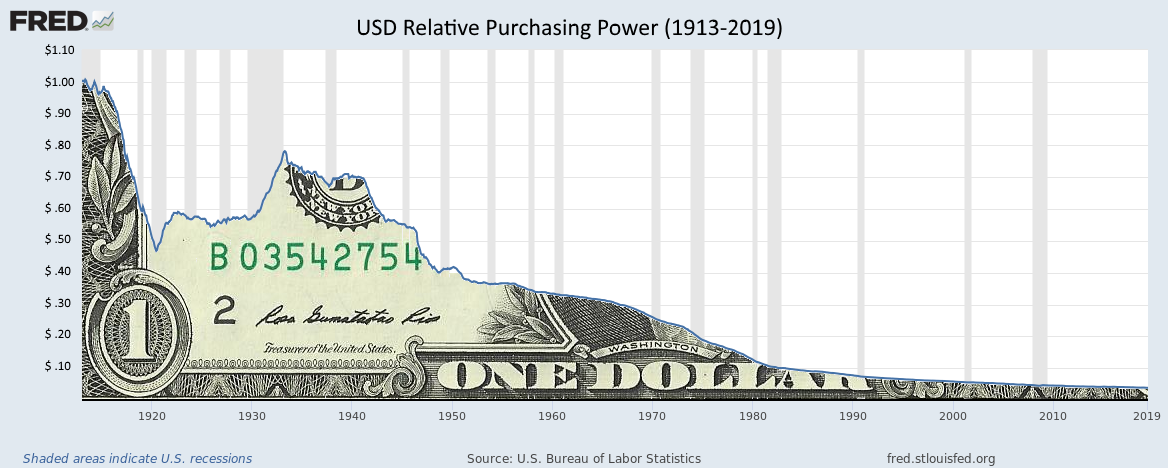

Firstly, here is a chart that shows the declining purchasing power of the US dollar. It only goes as far as 2019, but it gets the point across.

Starting at the year 1900, we can see that a US dollar was valued at one dollar. So why is a US dollar not valued at one dollar now? The answer is silver. A dollar coin minted in 1900 is made of 90% silver and contains 0.7717 troy ounces (or 24 grams) of silver content. A dollar created now does not contain a speck of silver. Now that we have a workable link between a dollar and silver, we can start to calculate what the value of silver is.

Using the chart above, if the value of a US dollar is approximately $0.04, we can use this to value silver. Here comes the math:

24 grams of silver was valued at $1.00 in the year 1900. Now that same dollar has fallen to $0.04.

24 ÷ $0.04 = $600

Since 24 grams is not a troy ounce, we need to multiply 24 grams by 1.295833 to get 31.1 grams (one troy ounce)

Now let's recalculate to adjust for a troy ounce of silver.

24 x 1.295833 ÷ $0.04 = $777.50

This is what I believe silver's value should be in US dollars (using 2019 data). Now of course, if the value of the US dollar should decline further, a simple adjustment could be made in the formula. Simply replace the '$0.04' with the new amount and calculate again.

Just for fun, let's do a US value of $0.001 (a tenth of a cent)

24 x 1.295833 ÷ $0.001 = $31,100 (rounding)

Will

silverbread ever reach this absurd valuation? I think the better question is: Will the US dollar ever become worthless? If so, anything divided by 0 equals infinity. So it's not a question of how high can silver's value reach, but how low will the value of the US dollar go?generic analysis that has little to do with the value of silver.

(I know I've missed replacing all of the word silver with the word bread)

HH

-

1 hour ago, CaptCaveMan said:

Whoa! £1,314 - where did that come from?

manipulation

1 hour ago, Bumble said:

1 hour ago, Bumble said:Yes, there are seasonal variations with the gold price, and Oct-mid-Dec is usually weak, while mid-Dec-Feb is usually strong.

HH

-

-

On 02/10/2021 at 22:05, TeaTime said:

Exactly this.

All the negativity around VAT is on the assumption that you will sell at spot price rather than market value. It's nonsense.

on the contrary to it being nonsense. the rate of taxes on potential 'investments' such as silver have

a real impact on return on investment. higher taxes makes it harder for you to pass the costs to a buyer.

assuming that you did find a buyer that is willing to pay all of the higher taxes, your return on investment

would be lower due to needing a higher outlay to make the same returns.(do the detailed maths if you

don't believe me).

HH

-

36 minutes ago, HerefordBullyun said:

Thats in members section hes not a member

more of an excuse than an explanation for purposely going off topic by promoting uranium.

1 hour ago, ksingh said:Uranium has been performing really well past few months.

Stock indicator "uuuu" energy fuels.should we allow all non members to go off topic with the latest fad?

HH

-

5 hours ago, SidS said:

I want to paraphrase something Maloney said in one of his videos on the History of Money. He asked a room full of children which was the odd one out - when shown a picture of US dollars, Monopoly money and a $20 gold coin. They said something along the lines of 'the gold is money because its valuable, the others are just paper'.

mike maloney should have done the same experiment pre 1971(1968) with fully gold backed US dollars.

my guess is the outcome would be the same. physical appearance is all that mattered to the children.

two pieces of paper versus a shiny thing. the fact that pre 1971, one of those pieces of paper is equal to

a shiny thing is beyond the children's comprehension. kids do funny things for seemingly random reasons.

@KevinFlynn imo you are asking all the wrong questions.

1. if stacking is the process of converting currency into metals then what is your purpose for stacking?

(answering this leads to what quantity to stack? and which metal ratio is best for that purpose?)

changing vat figures doesn't change the purpose of why people stack. it does however change the

figures and ratios that would best fit their purpose for stacking. many of your questions is about the

perception of stacking and other peoples opinion(including those such as mike maloney who have

much to gain from encouraging more buying of metals/silver). few on the forum actually do the maths

for their risk to reward ratio of what they are stacking. using historic averages/probabilities and doing

the maths using your personal figures will tell you what ratio is likely best.

my current ratio is weighted towards gold because the maths says it's likely favourable to do so.

updating the likely return on investment is always handy when the figures change.

HH

- Griffo, KevinFlynn and FlorinCollector

-

3

3

-

1 hour ago, HerefordBullyun said:

Of course it is. Why would you pay for something you not going to get.

so all forms of credit is illegal, or should be?

(I hope you're making purchases with your credit card because you haven't paid £'s into it yet. it's funny money that?)

HH

Is holding silver a hedge against inflation? Can you show me the math?

in General Precious Metals

Posted

instead of dodging the question,

explain why inflation was not equal to the -90% drop that the silver price experienced between 1980-2000.

HH