-

The above Banner is a Sponsored Banner. Upgrade to Premium Membership to remove this Banner & All Google Ads. For full list of Premium Member benefits Click HERE.

GoldCore

Content Type

Forums

Premium Membership

Dealer Directory

Wiki

Videos

Prize Draws

Posts posted by GoldCore

-

-

The Fed has indicated that rates will be raised but has offered no indication of when or by how much. Could this cause a melt-up in stocks before we see a massive correction? We ask our guest on this episode of GoldCore TV, Technical Analyst, Gary Savage of Smart Money Tracker.

-

We wrote last week in The Impressive Long Term Purchasing Power of Gold & Silver about how brand-new Corvettes go up in price every year, but a Corvette in terms of ounces of gold and silver ounces had the same purchase price in 2020 as in 1971!

For decades General Motors have poured all their best science, technology, and labour into this sports car, and the value of silver kept pace. In both 1971 and 2020, a brand-new Corvette could be had for 3,600 ounces of silver.

This proves silver was a better currency for investors to store value than paper money. The paper cost of a Corvette moved from US$5,500 to US$68,000!

So, we know that silver is a great saving vehicle. How do we know? Because both silver and gold are better saving vehicles than paper money, especially over periods of time longer than a single year.

This is because government and banks keep inventing money and leverage so that more fiat money exists every year. No one can invent or print precious metals so they retain purchasing power while fiat money cannot.

Every time that government announces new spending or new liquidity it means they are dealing in things that can be printed to solve problems which they believe can be papered over.

Gold or Silver- Which is a Better Investment?

Either precious metal will preserve purchasing power better than fiat money can … just ask anyone from Germany. Gold and silver move together against paper money; thus, we say silver and gold correlates to each other. But is silver a better saving vehicle than gold?

This is a vital question for precious metal investors. The long answer is that sometimes gold is better, sometimes silver is better, and below we explain how to tell. Essentially when the correlation or ratio between silver and gold is at historically extreme levels, it’s best to buy both metals, but buy more of the cheaper metal.

For thousands of years of human history gold and silver have competed with each other to be used as money and be used as a savings vehicle.Today we can look back over time to see the price, or ratio, at which silver traded in comparison to gold.

This look back is exactly the same idea as measuring Corvettes in ounces of silver, but we measure gold in ounces of silver [or silver in ounces of gold, it’s the same thing].

Gold/Silver Ratio: What is it and Why We Must Care

Below is a chart of silver against gold for the past 50 years. Keep in mind, this chart begins in the period of time when gold was still mandated against the US dollar, but silver was not.So, it’s fair to expect gold to climb against silver for the first 15 years, starting from levels that are unlikely to ever be repeated.

We show a straight line on the chart at 63 ounces of silver per ounce of gold, the calculated average price of silver against gold for the 50 years shown.

Today silver looks super cheap against gold on this chart. We can see that it currently takes 75 ounces of silver to equal a single gold ounce. During the COVID crisis, it was best to buy both metals since so much fiat money was printed. However, it was also super smart to buy even more silver because 120 ounces of silver was equal to one ounce of gold.

Why does silver get to these extreme values against gold? Well, the two metals certainly have a correlation or relationship like brothers, but one brother is into Etsy and the other is into meditation, so different things get them excited.Silver is like an Etsy maker. It’s so much more tied to industrial production, it is used in appliances, cars, healthcare, science etc. But gold is more like a patient meditator who is aware its role in the universe is to reflect others. So gold reacts to the panics of fiat money.

During COVID we see that silver went way down compared to gold because of both

A) the economy shut down so industrial demand for silver dropped and

Gold to Silver Ratio Chart many investors began to worry about governments printing fiat money so they moved into physical gold.

many investors began to worry about governments printing fiat money so they moved into physical gold.

It looks like a great plan to buy silver faster than gold. When silver is priced worse than 80 ounces of gold and combine that idea with buying silver slower than gold when silver is priced at 40 ounces or less per ounce of gold.- Tn21, modofantasma, Magritte and 1 other

-

4

4

-

The Impressive Long Term Purchasing Power of Gold & Silver

We saw a great meme on WallStreetSilver which sparked our essay idea for this week, the meme- The True Value of Gold and Silver compared how many ounces of silver it would take to purchase a corvette in 1950 compared to today – the answer was less!

This meme is a great example of the true value of silver over time. Below we reproduce the meme, but with the modification of the starting year of 1971 – which as we discussed in previous weeks is the year that then-President Nixon closed the Gold Exchange Window (see the post on August 19 “The Changing Role of Gold”).

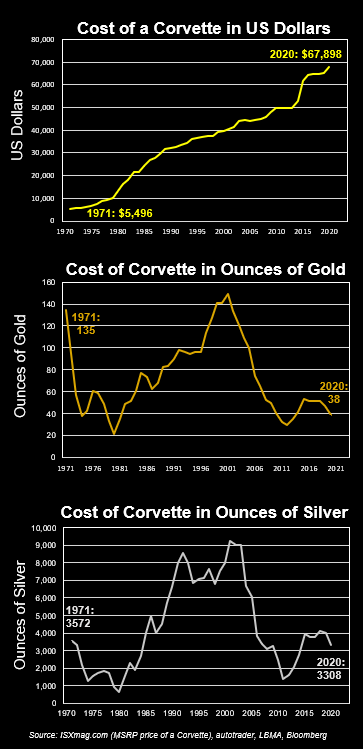

This is the year that the gold price was taken off the US$35 per ounce fix. As the meme below shows, the cost of a new Corvette in 1971 was $5,496. And that cost has increased to over US$67,000 in 2020 – an increase of 1235%.

However, if we ‘price’ the Corvette in terms of ounces of gold, the Corvette in 1971 would cost 135 ounces of gold compared to the cost of a Corvette in 2020 being only 38 ounces of gold!

The True Value of Gold and Silver

And when ‘priced’ in terms of ounces of silver, the Corvette in 1971 would have cost 3,572 ounces compared to only 3,308 ounces of silver needed to purchase a Corvette in 2020.

Digging deeper – below we chart the cost of a Corvette for all the years from 1971 to 2020, in the same three measures as above. In US dollar terms, ounces of gold, and ounces of silver.

What we can see is that the cost of a Corvette in US dollar terms has risen somewhat steady over the last 50 years.

The Long Term Purchasing Power of Gold and Silver

However, since gold and silver price markets do not move in a straight line. The cost of a Corvette in terms of ounces of gold and ounces of silver has changed significantly, the cost of a Corvette was as low as 21 ounces of gold and 631 ounces of silver in 1980. And the cost of Corvette was as high as 149 ounces of gold and 9259 ounces of silver in 2001.

So, although yes, it is true that the number of ounces of gold, and of silver, it takes to purchase a Corvette has gone through cycles over the last 50 years. The point we would like to close with is that, although this purchasing power of gold and silver is disrupted in the short and even medium-term – the long-term (50 years) purchasing power of gold and silver being able to purchase goods and services has remained impressively constant.

So this just shows evidence for how long the elastic relationship between paper money and precious metals can stretch…not for 50 years, but yes it can for 10 years and even 20 years.

-

In our post on August 11 titled End of an ERA: The Bretton Woods System and Gold Standard Exchange, we discussed the significance of then-President Nixon’s action of closing the gold window thereby ending the Bretton Woods Monetary system.

Under the Bretton Woods monetary system, central banks could exchange their US dollar reserves for gold. This also ended the gold fixed price of US$35 per ounce.

This week we explore the two questions that concluded last week’s article: What role can gold serve in the international financial system in the future? And why do central banks continue to increase their gold reserves?

Starting with the latter question of why central banks continue to increase their gold reserves?

This is an important factor in the gold market and therefore a topic we have discussed before – see our post from July 8: Central Banks Plan to Increase their Gold Reserves in 2021 – Here’s Why, for example.

The net demand from central banks has been positive since 2010 and collectively central banks hold over 35,000 metric tonnes of gold. This accounts for approximately a fifth of all gold ever mined.

Market to Crash by 80%

Watch David Hunter on GoldCore TVGold and its Primary Role

An article posted on Reuters by World Gold Council sums it up as: One of gold’s primary roles for central banks is to diversify their reserves. The banks are responsible for their nations’ currencies. However, these can be subject to swings in value depending on the perceived strength or weakness of the underlying economy.

At times of need, banks may be forced to print more money, Since interest rates, the traditional lever of monetary control, have been stuck near zero for over a decade. This increase in the money supply may be necessary to stave off economic turmoil. However, at the cost of devaluing the currency.

Gold, by contrast, is a finite physical commodity whose supply can’t easily be added to. As such, it is a natural hedge against inflation.

As gold carries no credit or counterparty risks, it serves as a source of trust in a country, and in all economic environments. Making it one of the most crucial reserve assets worldwide, alongside government bonds.

For more on central banks gold holdings see the dashboard below:

Central Bank Gold Holdings Interactive Charts

Therefore, the bottom line is that central banks are buying gold for many of the same reasons you and I are buying gold. Gold cannot be ‘printed’ by the Fed, the ECB, or any other central bank. In other words, this means gold is not subject to debasement.

And gold has attractive portfolio characteristics. In a central bank portfolio consisting of only a few currencies that might qualify as reserve currencies (i.e., the dollar, the euro and the yen), gold provides excellent diversification characteristics. For example, gold is very inversely correlated to the US dollar, meaning that in general if the US dollar goes down that the price of gold increases.)

Gold and the International Financial System

Turning to the first question of what role can gold serve in the international financial system in the future?

Also, the fact that many central banks are again interested in gold for reserve purposes suggests that a new, semi-official, role for gold could emerge in the future.

One example of a role for gold is future inclusion in the basket of currencies that make up the International Monetary Fund’s (IMF) Special Drawing Rights (SDR) currency basket.

The SDR is an IMF-sponsored currency basket. Presently includes the dollar, yen, pound, euro, and renminbi (the basket weights of each are determined by the size of GDP, trade, etc.).

When first introduced in 1968 the SDR was meant to supplant the role of both the dollar and gold in central bank reserves. The SDR was initially referred to as ‘paper gold’, and its initial value was set equal to one US dollar.

Download Your Free Guide

Click Here to Download Your Copy NowSuffice it to say the SDR failed to supplant the dollar; the dollar is much more useful to central banks. As it can be widely invested and used in foreign exchange market intervention.

Indeed, today the SDR is still a largely irrelevant currency for everything other than specific, narrow transactions with the IMF

Why might the IMF include gold in the SDR at some future point? Simply because gold is again regarded as a financial asset by an increasing number of central banks! Ben Bernanke may have answered Ron Paul on July 13 (2011) with “gold is not money”, but he did allow that gold is a financial asset, like a Treasury bill.

Given that financial assets are commonly pledged as collateral. One implication is that gold’s role as financial collateral will almost certainly expand again, regardless of IMF policy.

Gold is not a currency, at least not in the sense that there is a national central bank that creates it and sets its interest rate. But to many investors, including central banks, gold is a “currency” of sorts: it is the original currency (the original store of value, unit of account, medium of exchange) in which other, fiat, currencies were later defined.

Emerging Markets Drive Gold Prices

Watch Louis Gave on GoldCore TVGold would enhance the acceptability of the SDR. That means such large-reserve countries as China, India and Russia might well hold more SDRs in their reserves.

There are potentially lesser, non-official roles for gold in the monetary system. These too rest on gold’s acceptability as a financial asset and collateral.

Gold could be a key component of a new commodity basket that central banks will use as a monetary policy price target. Moreover, gold could be used as collateral for publicly-floated government bonds.

In addition, gold could serve as an unofficial fix for a currency in which markets have suddenly lost confidence; this would be a temporary function for gold, but a currency backed by gold. Or where the central bank holds significant gold reserves, provides confidence.

In addition, to reiterate the above points about reasons central banks hold gold. Hungary’s central bank increased its gold reserves to 94.5 tonnes (from 31.5 tonnes) earlier this year and cited the reasons for increasing its reserves as: 1.) long-term national and economic policy strategy objectives.

And went on to say the appearance of global spikes in government debts or inflation concerns further increase the importance of gold in national strategy as a safe-haven asset and as a store of value and 2.) the central bank stated that gold is one of the most crucial reserve assets worldwide [that has] no credit or counterparty risks.

From The Trading Desk

Stock Update:

Silver Britannia’s offer for the UK! We have limited availability of Silver Britannia Monster boxes and Silver Britannia Tubes of 25.

We have just taken delivery of 10,000 2021 Silver Britannia’s directly from the Royal Mint.

Supplies are very limited. We are offering these at the lowest premium in the market at Spot plus 44% (which includes VAT at 20%). Please contact our sales team to avail of this offer.

Gold Britannia’s 1oz coins start at 6.5% over the spot.

Krugerrands are currently the lowest premium on 1oz coins at spot plus 5.5%.

Excellent stock and availability on all gold coins and bars with 1oz bars at a very competitive 3.75% over spot.

Silver 100oz and 1000oz bars are also available VAT-free in Zurich.

Please see below our extended trading hours.

** We have extended our opening hours. Phone lines, online ordering and WebChat are now open until 09:00-22:00 (Europe/Dublin) USA 09:00 to 17:00 EST**

Market Update:

Gold is a little under pressure but still holding near term support given that bond yields are rising again and the stronger dollar.

We have a stronger dollar on the back of a market risk off with equities down yesterday and the VIX had its biggest jump since May, equity markets are down again this morning. Let’s see if there is more to this as the week closes out.

Hawkish Fed minutes showed that officials discussed tapering before the end of the year but a tweet from Otavio Costa @Tavicosta yesterday sums up why the fed timing on tapering may be too late.

‘The Citi economic surprise index for G-10 economies just turned negative for the first time since the Covid-19 crash.

A fresh reminder the Fed’s timing for removing liquidity from the market is always impeccable…….’

Gold price near term support on the downside is $1750 area, however, the risk-off trading in the global stocks combined with weaker Treasury could likely offer some reprieve for Gold.

From a bullish perspective, Gold needs to get back over the $1800 level and close there on a daily basis.

Buy Gold Coins

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

18-08-2021 1788.10 1783.45 1300.13 1295.32 1525.61 1522.00

17-08-2021 1794.05 1789.45 1299.61 1300.57 1524.22 1524.61

16-08-2021 1775.75 1786.35 1281.91 1291.53 1507.61 1517.15

13-08-2021 1757.65 1773.85 1273.59 1281.07 1496.64 1506.35

12-08-2021 1755.50 1747.40 1266.24 1262.85 1494.81 1489.66

11-08-2021 1734.05 1743.60 1255.45 1258.88 1480.53 1486.42

10-08-2021 1729.55 1723.35 1248.22 1244.60 1475.13 1471.05

09-08-2021 1741.50 1738.85 1253.88 1254.06 1481.32 1479.24

06-08-2021 1799.45 1762.90 1292.90 1269.64 1523.59 1497.58

05-08-2021 1811.20 1800.75 1302.07 1294.92 1529.74 1521.63Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here

-

David Hunter, Chief Macro Strategist at Contrarian Macro Advisors is this week's guest on GoldCore TV with Dave Russell. According to David, a global bust could occur in 2022, with a potential market crash of 80%.

Watch the Video to Learn More

Also covered in this episode…

-

Is the Fed still not ready to taper despite growing inflation?

-

Where does this leave gold, silver, and the US dollar?

-

What will happen to the US dollar if money printing continues and inflation rises?

- Is $2,500 the next stop for gold? And $50 for silver?

Make sure you don’t miss a single episode… Subscribe to our YouTube channel

Click Here to Download Your Copy Now

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

16-08-2021 1775.75 1786.35 1281.91 1291.53 1507.61 1517.15

13-08-2021 1757.65 1773.85 1273.59 1281.07 1496.64 1506.35

12-08-2021 1755.50 1747.40 1266.24 1262.85 1494.81 1489.66

11-08-2021 1734.05 1743.60 1255.45 1258.88 1480.53 1486.42

10-08-2021 1729.55 1723.35 1248.22 1244.60 1475.13 1471.05

09-08-2021 1741.50 1738.85 1253.88 1254.06 1481.32 1479.24

06-08-2021 1799.45 1762.90 1292.90 1269.64 1523.59 1497.58

05-08-2021 1811.20 1800.75 1302.07 1294.92 1529.74 1521.63

04-08-2021 1812.45 1829.10 1301.34 1311.83 1528.44 1538.82

03-08-2021 1809.70 1812.65 1300.81 1305.11 1523.04 1527.16Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

-

Is the Fed still not ready to taper despite growing inflation?

-

On today's episode of GoldCore TV, Louis Gave of GaveKal joins Dave Russell to discuss whether the gold market can rebound quickly after the recent flash crash? Louis also gives his interpretation of the current state of financial markets and his views on central banks' digital currency and the future of Bitcoin.

Watch the Video to Learn More

Also covered in this episode…

- Will the Fed be able to implement tapering or any modest tightening of monetary policy?

- How the western world has become more China-like in the last 20 years.

- Why China is promoting its own cryptocurrency, the digital renminbi since it provides the government a lot of authority, control, and flexibility.

- As central bank digital coins become much more prolific will there still be room for Bitcoin?

- Can gold recover? Flash Crash Explained

- Why and how emerging markets are driving gold prices

- What would a rise in long bond yields mean for gold?

Make sure you don’t miss a single episode… Subscribe to our YouTube channel

Click Here to Download Your Copy Now

What on Earth is Going on with Silver?

Watch Patrick Karim on GoldCore TV

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

11-08-2021 1734.05 1743.60 1255.45 1258.88 1480.53 1486.42

10-08-2021 1729.55 1723.35 1248.22 1244.60 1475.13 1471.05

09-08-2021 1741.50 1738.85 1253.88 1254.06 1481.32 1479.24

06-08-2021 1799.45 1762.90 1292.90 1269.64 1523.59 1497.58

05-08-2021 1811.20 1800.75 1302.07 1294.92 1529.74 1521.63

04-08-2021 1812.45 1829.10 1301.34 1311.83 1528.44 1538.82

03-08-2021 1809.70 1812.65 1300.81 1305.11 1523.04 1527.16

02-08-2021 1807.55 1811.45 1298.36 1302.61 1521.05 1524.34

30-07-2021 1828.25 1825.75 1307.75 1308.52 1535.73 1536.92

29-07-2021 1819.45 1829.30 1304.00 1309.05 1532.16 1539.54Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox - Sign Up Here

Gold Leads the Way for Silver

in General Precious Metals

Posted

Gold leads the way

Last week we wrote about the gold to silver ratio. Our points were that it measures the price of one metal against the other, just as we use the dollars per ounce to measure daily metals prices, and just as we use ounces per Corvette to measure purchasing power preservation.

Also, we discussed the range of movement that silver has around gold over the past fifty years. We laid out notes for when to buy silver against gold, and when not to.

The Long Run Relationship Between Gold and Silver

Today we expand on the gold to silver relationship. Traditionally, gold moves first, with silver following but moving relatively more.

Since the 1970s, in all the big price moves studied, we find that although silver goes farther, gold leads the way by moving first.

This is so important because it means that silver investors can typically get a free look at the future before they need to commit money. It also shows that gold and silver respond slightly different to the same global events.

The two metals response to Covid-19 in 2020 is a great example of the gold price jumped higher prior to the move in silver.

2020 started as a normal year. In March the world began to fall apart because Covid-19 was spreading rapidly everywhere, there was no cure and little understanding of the related science.

Governments around the globe closed their economies as much as possible with the aim of preventing spread from one human to another. By early June 2020 governments made clear to everyone that they will replace lost income or wages or rent with money from the government. That message was everywhere!

Silver Set to Follow Gold

Gold got the message before silver. In fact, from June until August 2020 gold ran from US$1685 up to US$2065 per ounce. Gold investors quickly understood that governments did not have enough cash on hand to make all these income replacement payments, so more debt and more printing was coming.

Gold rallied more than 20% over this time period. But silver did nothing for over a week in early June while gold was running.

Why? Because silver is more tied to industrial production and GDP figures than gold is, so for over a week silver was trapped by the fear that maybe buying more silver because of new government debts and money printing would be a bad idea since the closed economy meant drops in physical silver demand for industrial use.

Silver roared to the party once gold moved far enough to show the new path was up. Silver moved more than 65% versus just 20% for gold!

Starting at the US $17.40 silver increased to $29.13 in those same 2 months despite waiting more than a week to get started.

To recap Q3 2020: gold moved first, silver moved second, gold went up 20%, but silver went up more than three times that!

It turns out that this pattern of events in 2020 is not unusual. If you study all the 20% price increases for silver and gold since 1975 the results are striking. On 85 different occasions, two metals rallied more than 20% in tandem.

On 60 of those 85 occasions, gold led silver by 3 days! Gold was moving up for 3 days before silver even moved at all. After adding up all the 85 occurrences and making some observations about the average. We see that a price move that pushed gold up 20% will mean that silver, on average moves up 39%.

Or double the percent increase of gold! Silver has been called the poor man’s gold because it is priced less per ounce, moves farther per ounce, and moves second. The lesson this week is to pay special attention when the gold price starts an up move, and silver just sits.

The likelihood that silver will begin to rise after gold is high. So, if gold is up four days running while silver sits. The math above hints that silver is planning to get itself caught up to gold’s rally and maybe even blow past it to run farther.